Penske Automotive says earnings improved 4.5% in Q4; stock rises

|

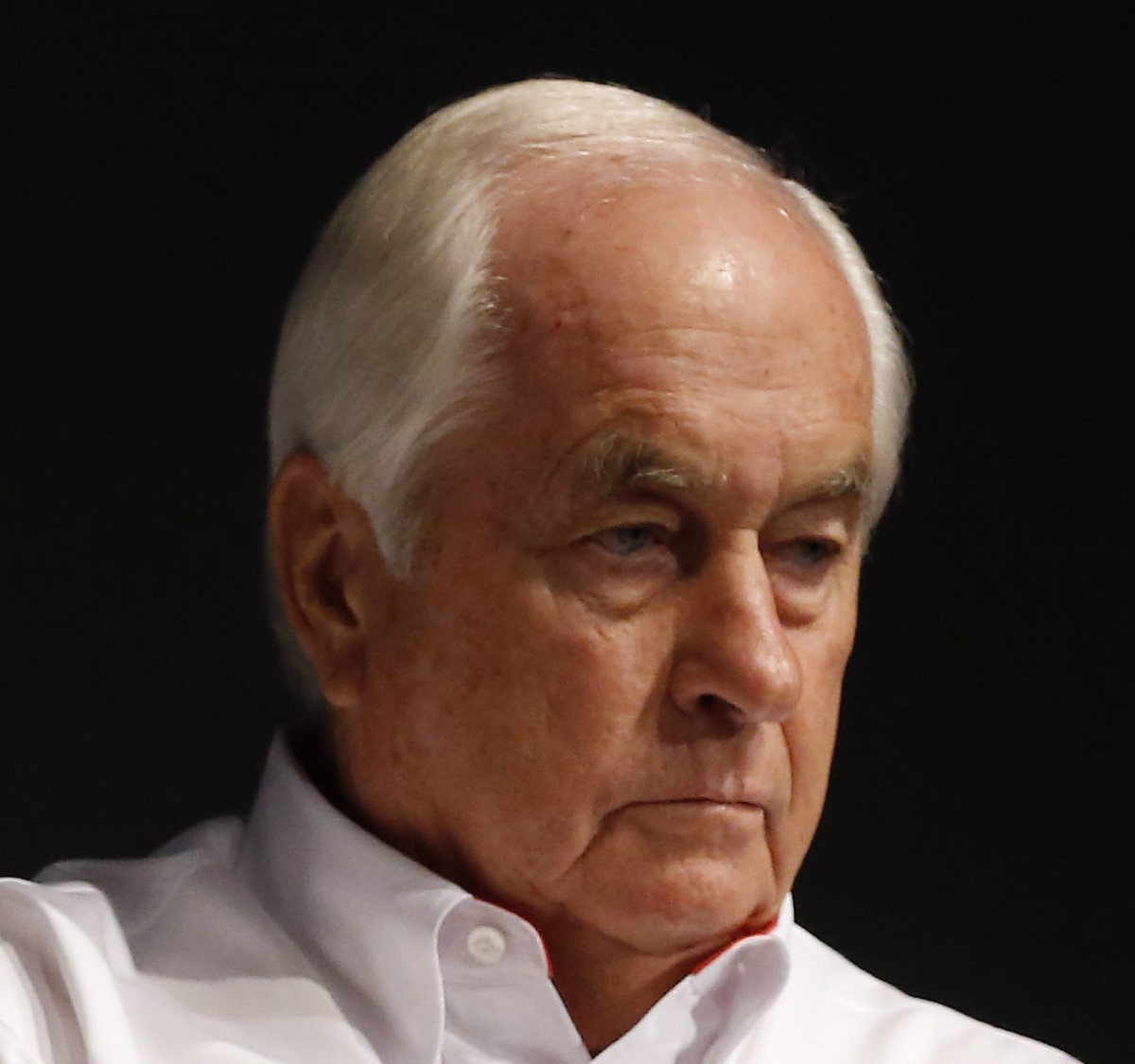

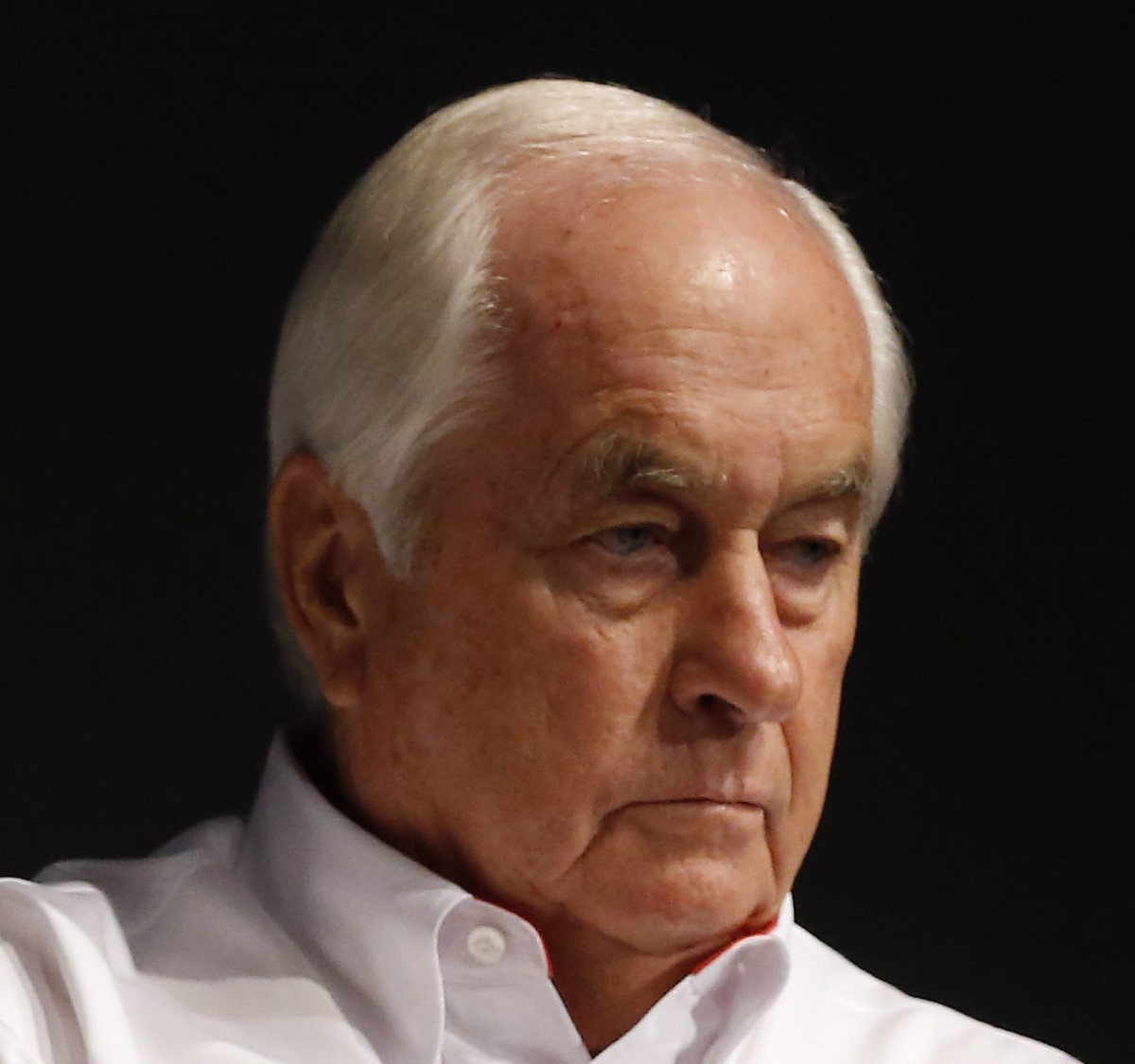

| Roger Penske – raking in the money |

Penske Automotive Group today posted mixed results for the fourth quarter as earnings from continuing operations improved but net income fell.

The company said continuing operations income rose 4.5 percent to $73 million, but net income dropped 2.6 percent to $71.3 million.

Total revenue rose 11 percent in the quarter to $4.9 billion.

Wall Street liked the results, pushing Penske Automotive shares up 1 percent to close at $31.36 while the Dow Jones industrial average plunged 1.6 percent for the day. Penske shares remain near 52-week lows after topping out at $54.39 last summer.

Because of its lower stock price compared to high prices for dealerships in the buy-sell market, Chairman Roger Penske said the company will be prudent on dealership acquisitions this year.

“We’re going to look at acquisitions use of capital versus stock buy-back based on these lower stock prices," Penske said in an interview today with Automotive News. “We’re going to be very prudent on what we buy here domestically because of the prices."

The retailer reported a 0.8 percent drop in the same-store average transaction price per new vehicle to $40,418. Same-store average gross profit per unit also dropped, but not as steep as some of Penske’s peers reported.

The average gross profit per new car was $3,047, down by $146. On used cars it was $1,541, a $115 decline.

Roger Penske credited the retailer’s product mix and pricing discipline to staving off bigger losses.

“We have 12 Land Rover stores in the United Kingdom and we have Land Rover here. Those are double-digit margins," Penske said in a conference call with analysts. “We have Porsche stores. When you blend these all together, we get the benefit of our mix."

Penske said because dealership managers' compensation is tied to gross margin and the fact that there is little inner brand competition for premium luxury vehicles, which comprise most of Penske’s mix, “Our guys did a pretty good job holding onto gross."

In a race

Still, he said he is in a race against other public groups to not let margins tighten any further. “I’m half a lap ahead of these guys because of our gross profit, but we have to watch our back because these things can shift very quickly."

Penske Auto Group’s cost of sales and other expenses, including the maintenance costs on its 7,000 loaner cars, rose about 2 percent. Penske said the company’s diverse business model offset some of those costs, helping deliver record revenue.

“The diversification provided by our business model continues to drive our business forward," Penske said in a statement today. “Our U.K.-based retail automotive and U.S.-based commercial truck businesses produced exceptional results, and the stability of the parts and service business helped our business produce another solid quarter."

Looking ahead

He said 2016 will be another “solid year" for Penske’s automotive retail and commercial truck sales.

Penske Automotive said it was helped by a stronger performance in all areas of the business: new vehicles, used vehicles, parts and service and finance and insurance.

The U.S. accounted for about 61.7 percent of Penske’s revenue mix, the U.K. 30.5 percent and other international holdings 7.8 percent.

On a same-store basis, retail revenue increased to $4.35 billion from $4.16 billion. Penske had an increase in service and parts retail revenue to $445.8 million from $431.9 million.

Penske Automotive’s same-store retail sales of new vehicles rose 2.5 percent in the quarter to 55,580 units. That's compared with an 8 percent gain for the U.S. market to 4.4 million vehicles, according to the Automotive News data center.

Fourth-quarter same-store used retail sales at Penske improved 2.3 percent to 45,150.

Annual results

Penske Automotive also reported strong results for all of 2015.

Full-year earnings from continuing operations gained 13 percent to $329.6 million.

Net income rose 14 percent to $330.4 million, and revenue surged 12 percent to $19.3 billion.

For the full year, total same-store sales volume rose 4.6 percent to 223,692 new vehicles. Total U.S. new-vehicle sales gained 5.7 percent to a record 17.5 million last year.

Penske's used vehicles retailed increased to 189,548 from 180,155 last year. Autonews