Clean cars could tank oil prices by 2025

| AR1.com has stated on numerous occasions that oil prices will never skyrocket again. The oil companies know they had better pump as much out of the ground as they can while they still have people willing to buy their filthy product |

Energy companies and analysts are ramping up their long-term projections for electric vehicles because of falling costs and expanded range — but forecasts still vary widely.

The trend speaks to the uncertainty surrounding the technology, which all major automakers have endorsed, despite seeing sales consistently fall below expectations in the short term. The introduction of more affordable and longer-range vehicles like the Chevrolet Bolt and the Tesla Model 3 could be a turning point, but analysts caution that widespread acceptance will take decades.

One of the most bullish predictions comes in a report released yesterday by the Grantham Institute for Imperial College London and the Carbon Tracker Initiative. It suggests that electric vehicles could make up around 35 percent of the road transport market in 2035 and two-thirds by 2050.

Electric vehicles cracked 1 percent of U.S. new car sales last year.

"The oil and gas industry feels that EVs aren't anywhere past being niche products," said Luke Sussams, a senior researcher at Carbon Tracker and one of the authors of the report. "The model shows what might happen if EVs are further along that S curve [of consumer acceptance], just before that inflection point of mass uptick."

|

| Chevy Bolt |

The scenario outlined in the report, which also includes an aggressive projection for solar energy, would see oil and coal demand peak in 2020 and fall through 2050. The amount of oil displaced by EVs could reach around 2 million barrels per day by 2025 — the same volume that caused the 2014-15 oil price collapse.

By comparison, the U.S. Energy Information Administration, the International Energy Agency and BP PLC expect oil demand to continue rising through 2040. The World Energy Council expects peak demand in 2030.

Sussams acknowledged that his report lays out an aggressive projection.

"On the whole, it seems like the energy industry and fossil fuels themselves are playing catch-up with regard to low-carbon transportation, so this was looking to get ahead of the curve," Sussams said.

BP's 2017 Energy Outlook projects that EVs could make up just 6 percent of global market share by 2035. EIA's Annual Energy Outlook 2017 expects they'll make up 8 percent of U.S. market share by 2035.

Others are more optimistic. Bloomberg New Energy Finance projects that EVs will make up 35 percent of new car sales globally by 2040.

Batteries are cheaper

|

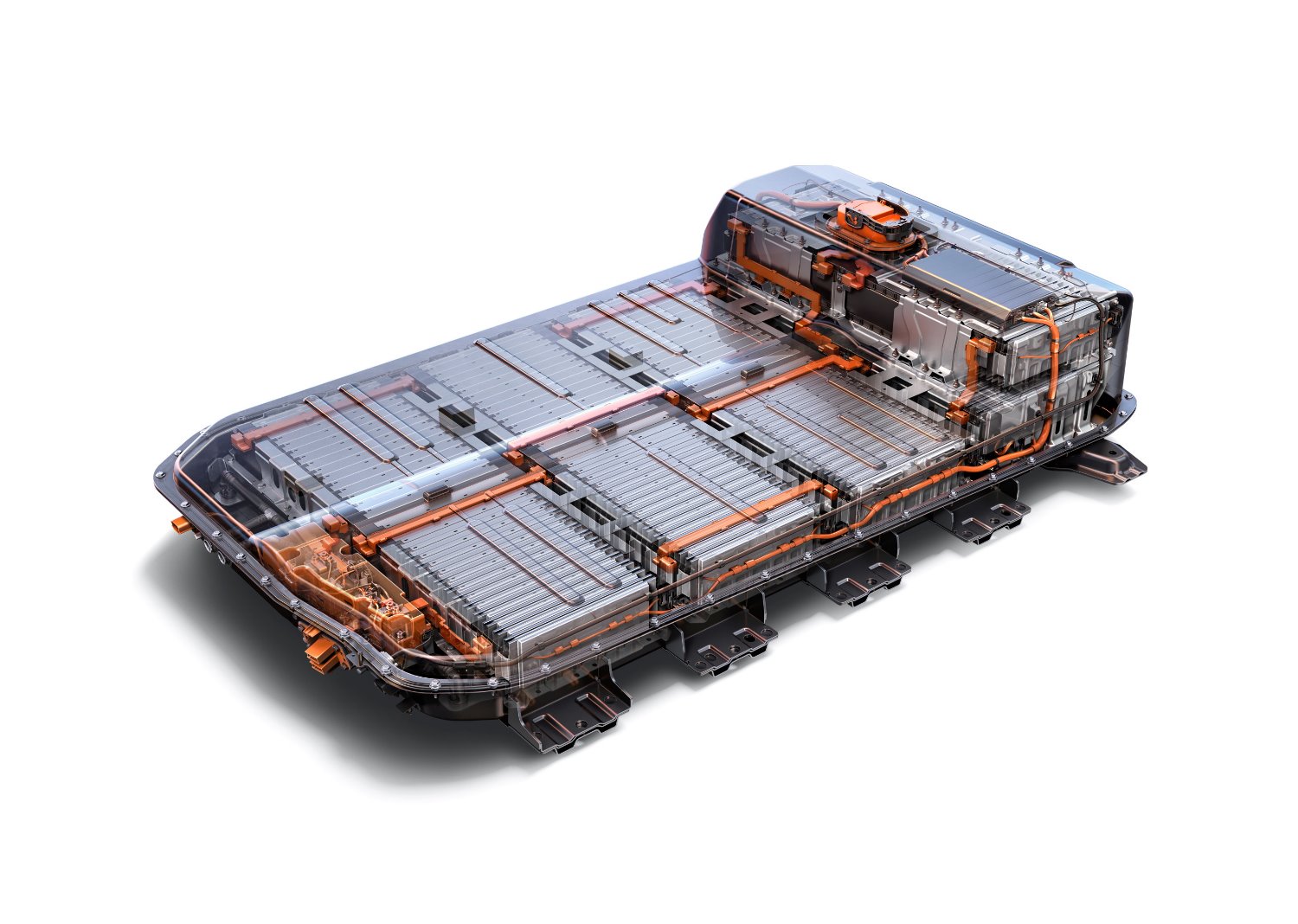

| Chevy Bolt Battery Pack |

One thing the forecasts have in common is that they are all showing a higher uptick in the long term than in previous years.

Sussams' own estimates were significantly lower two years ago. In 2014, he predicted that EVs wouldn't be cost-competitive with traditional internal-combustion engine vehicles until 2050. But battery costs have dropped significantly since then. One Energy Department study found that battery costs have fallen from $1,000 per kilowatt-hour in 2008 to $268 per kWh in 2015, a 73 percent reduction. Now, Sussams predicts that EVs could be cost-competitive with internal-combustion vehicles by 2020.

The drop in battery costs has led to significant adjustments in expectations for long-term growth.

EIA's 2017 energy outlook nearly doubles its forecast for EV market share from last year and multiplies its forecast from 2014 by nearly 10.

BP more than doubled its forecast from last year. It now expects around 100 million EVs by 2035, compared with a previous estimate of 30 million.

"It depends on a whole lot of unknowns, like changing patterns of fuel economy standards, battery costs, efficiency gains in conventional cars, consumer preferences [and] oil prices," Spencer Dale, group chief economist at BP, said in a presentation at Columbia University's Center for Global Energy.

Those unknowns could lead to even faster growth for EVs than expected, he said, but the clean vehicles would still make up a small portion of overall cars.

"Even a very rapid growth of EVs is unlikely to be game-changing for oil demand," Dale added.

Even the most optimistic scenarios for EVs don't predict significant cuts in carbon emissions from transportation, now the largest source of pollution in the United States. The estimates by BNEF or Grantham and Carbon Tracker don't keep the world anywhere close to just 2 degrees Celsius of global warming, according to the report.