ISC Announces Merger Agreement With NASCAR Holdings, Inc. (2nd Update)

|

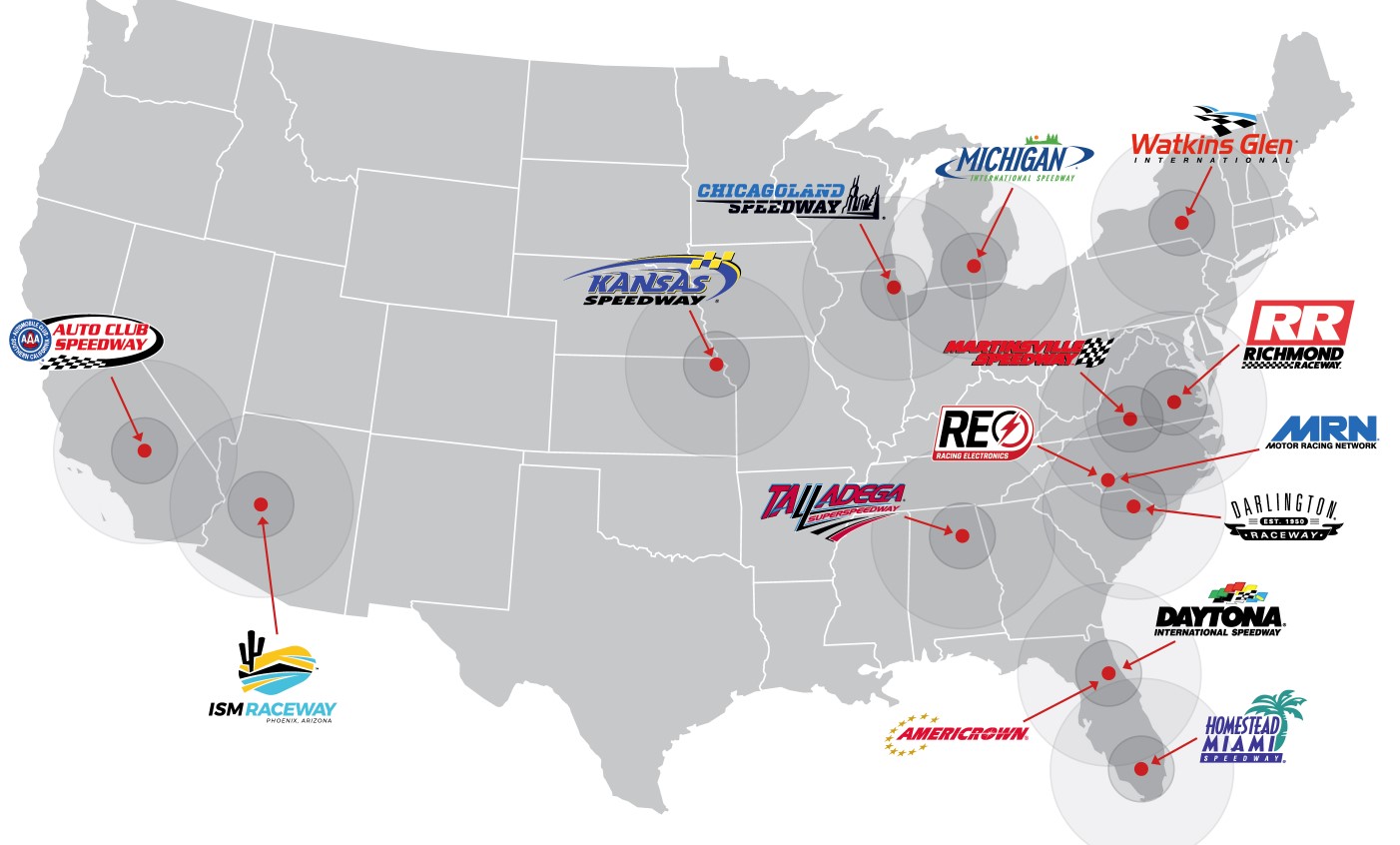

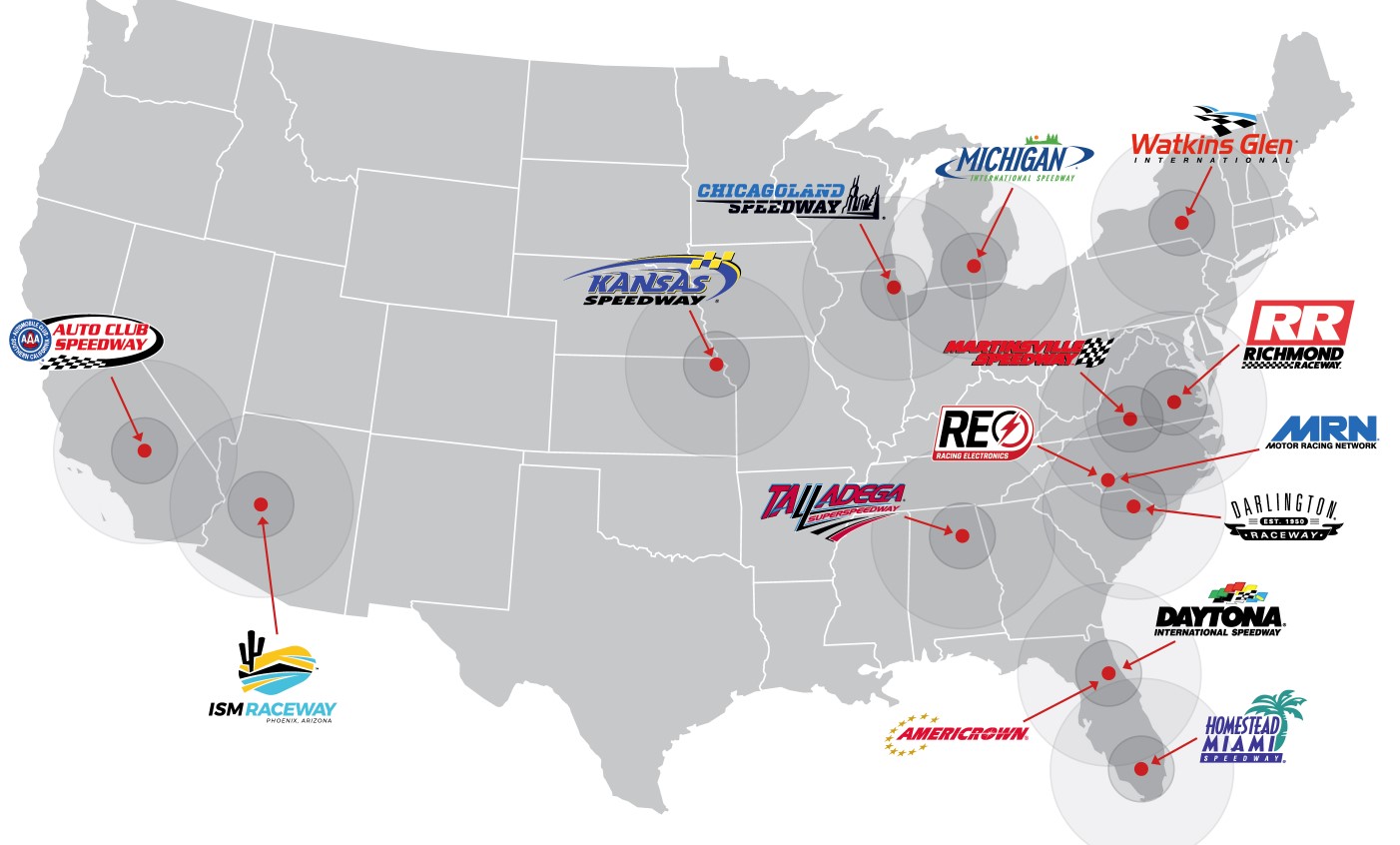

| ISC facilities. Once deal closes the France Family, should they choose, can sell it all to Liberty |

UPDATE Wells Fargo has dropped International Speedway (ISCA -0.7%) to an Underperform rating from Market Perform.

"We see no upside potential to the current share price given pending minority shareholder approval of $45/share cash acquisition offer by NASCAR for the ~25% of voting shares not controlled by the France family," advises WF.

The firm also sees downside risk on the low chance that minority shareholders reject the deal.

Wells' price target of $41 is below the sell-side average PT of 44.

05/22/19 In Daytona Beach, Clayton Park notes the NASCAR-ISC merger "makes sense for a number of reasons."

Both companies "already have their respective headquarters in the same building" across from Daytona Int'l Speedway, while both are "already led by the France family."

Combining the companies also would "allow for greater efficiencies including the elimination of redundant positions, such as having separate human resources or marketing departments."

It also would allow for the two entities "to make decisions and respond to changes in the industry, as well as NASCAR fan preferences, more quickly." NEWS-JOURNALONLINE.com

05/22/19 International Speedway Corporation (NASDAQ Global Select Market: ISCA; OTC Bulletin Board: ISCB) (“ISC") announced today that it has entered into an Agreement and Plan of Merger (“Merger Agreement") with NASCAR Holdings, Inc. (“NASCAR") pursuant to which NASCAR will acquire ISC. The transaction is valued at approximately $2.0 billion. The consideration to be paid to ISC’s shareholders (other than certain controlling shareholders of ISC and certain related entities (the “Participating Shareholders")) will be $45.00 in cash for each share of ISC Class A Common Stock and ISC Class B Common Stock. The Merger Agreement was unanimously recommended and approved by a special committee comprised solely of independent directors of the Board of Directors of ISC (the “Board") and was unanimously approved by the full Board. In addition, the Participating Shareholders have signed a letter agreement to cause their respective shares of ISC Class A Common Stock and ISC Class B Common Stock to be transferred to NASCAR prior to the effective time of the merger.

TRANSACTION DETAILS

Under the terms of the Merger Agreement, ISC shareholders (other than the Participating Shareholders) will be entitled to receive $45.00 in cash, without interest, for each share of ISC Class A Common Stock and ISC Class B Common Stock held immediately prior to the effective time of the merger.

The transaction, which is expected to close in calendar year 2019, is conditioned on the approval of a majority of the aggregate voting power represented by the shares of ISC Class A Common Stock and ISC Class B Common Stock not owned by the controlling shareholders of ISC, voting together as a single class. The transaction is also conditioned on other customary closing conditions.

In connection with the transaction negotiations, counsel for the plaintiff in The Firemen’s Retirement System of St. Louis v. James C. France, et al., Case No. 2018-CA-032105-CICI (Seventh Judicial Circuit, Volusia County, Florida), the previously-disclosed class action lawsuit on behalf of ISC shareholders challenging the transaction, met with representatives of the Special Committee, and has determined to not challenge the fairness of the transaction price.

ADVISORS

Dean Bradley Osborne Partners LLC is serving as financial advisor to the ISC Special Committee, and Wachtell, Lipton, Rosen & Katz is acting as legal counsel to the ISC special committee. Goldman Sachs & Co. LLC is serving as exclusive financial advisor to NASCAR, and Baker Botts L.L.P. is acting as legal counsel for NASCAR. BDT & Company is serving as financial advisor to the France family. Saul Ewing Arnstein & Lehr LLP is acting as legal counsel to ISC.

NASCAR

NASCAR Holdings, Inc., through its subsidiaries, operates as a sports sanctioning body. It also provides news, statistics, and information services on races, drivers, teams, and industry events. NASCAR Holdings, Inc. was founded in 2004 and is based in Daytona Beach, Florida.

ISC

International Speedway Corporation is a leading promoter of motorsports activities, currently promoting more than 100 racing events annually as well as numerous other motorsports-related activities. ISC owns and/or operates 13 of the nation's major motorsports entertainment facilities, including Daytona International Speedway in Florida (home of the DAYTONA 500); Talladega Superspeedway in Alabama; Michigan International Speedway located outside Detroit; Richmond Raceway in Virginia; Auto Club Speedway of Southern California near Los Angeles; Kansas Speedway in Kansas City, Kansas; ISM Raceway near Phoenix, Arizona; Chicagoland Speedway and Route 66 Raceway near Chicago, Illinois; Homestead-Miami Speedway in Florida; Martinsville Speedway in Virginia; Darlington Raceway in South Carolina; and Watkins Glen International in New York.

ISC also owns and operates Motor Racing Network, the nation's largest independent sports radio network, Racing Electronics, the leader in motorsports communication technology and equipment and Americrown Service Corporation, a subsidiary that provides catering services, and food and beverage concessions. In addition, ISC owns ONE DAYTONA, the retail, dining and entertainment development across from Daytona International Speedway, and has a 50 percent interest in the Hollywood Casino at Kansas Speedway. For more information, visit ISC's Web site at www.internationalspeedwaycorporation.com.

IMPORTANT ADDITIONAL INFORMATION ABOUT THE TRANSACTION AND WHERE TO FIND IT

This communication is being made in respect of the proposed merger transaction (the “Merger") involving International Speedway Corporation(“ISC") and NASCAR Holdings, Inc. (“NASCAR"). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction, ISC will file a proxy statement and other documents with the Securities and Exchange Commission (the “SEC"). Before making any voting decision, investors and shareholders of ISC are urged to carefully read the definitive proxy statement when it becomes available because it will contain important information regarding ISC, NASCAR and the Merger.

A definitive proxy statement and form of proxy will be sent to ISC shareholders seeking their approval of the transaction. This press release is not a substitute for the proxy statement or any other document which ISC may file with the SEC in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS OF ISC ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The definitive proxy statement (when available) and other documents filed by ISC with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by ISC may be obtained free of charge from ISC at www.internationalspeedwaycorporation.com under investor relations.

PARTICIPATION IN THE SOLICITATION

ISC and certain of its directors, executive officers and other members of management and employees may, under the rules of the SEC, be deemed to be “participants" in the solicitation of proxies in connection with the Merger. Information concerning the interests of the persons who may be “participants" in the solicitation will be set forth in the proxy statement when it is filed with the SEC. You can find more detailed information about ISC’s executive officers and directors in its Information Statement filed with the SEC on March 12, 2019.