NASCAR News: We peer into our crystal ball to see who will take over the 23XI and FRM Charters

In the high-octane world of NASCAR, where engines roar and rivalries burn hotter than a summer race at Daytona, the 2025 season was supposed to be about crowning champions and chasing checkered flags. But off the track, a legal storm is brewing, threatening to upend the sport’s fragile ecosystem.

–by Mark Cipolloni–

The epicenter? The charters—those golden tickets guaranteeing teams a spot in every Cup Series race and a hefty slice of the purse. Without them, teams were relegated to “open” entries, scraping by on speed and luck, their futures as uncertain as a rookie driver’s first lap.

The spark was a lawsuit filed by 23XI Racing and Front Row Motorsports (FRM) against NASCAR and its iron-fisted overlords, the France family. 23XI, co-owned by basketball legend Michael Jordan and veteran driver Denny Hamlin, had stormed the scene with swagger and speed, fielding cars for stars like Tyler Reddick and Bubba Wallace. FRM, a scrappy Ford-backed outfit led by entrepreneur Bob Jenkins, rounded out the three-car fleets with drivers like Michael McDowell and Todd Gilliland. Together, they challenged NASCAR’s “monopolistic” control, refusing to sign the 2025 charter agreement that the other 13 teams had grudgingly accepted. They accused the sanctioning body of bullying tactics, unfair revenue splits, and clauses silencing dissent—like one barring teams from suing.

The courts initially sided with the rebels, granting an injunction allowing 23XI and FRM to race as chartered teams through the early 2025 season. But appeals dragged on, and by July, the U.S. Court of Appeals for the Fourth Circuit yanked the rug out. The teams were stripped of their six charters mid-season, forced to run as open teams at Dover and beyond. NASCAR, smelling blood, vowed to sell the disputed charters—three from 23XI and three from FRM—to the highest bidders.

“We have eager buyers lined up,” NASCAR’s lawyers declared in filings, redacting names but hinting at interest from current teams and fresh investors. The deadline loomed: October 1, 2025, to finalize sales for the 2026 season.

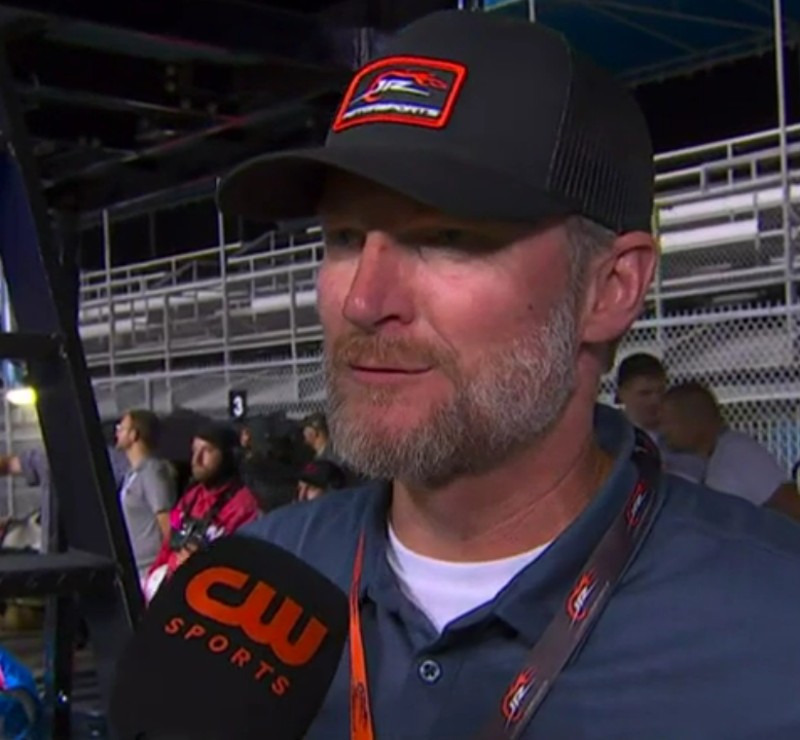

As August faded into September, the full trial loomed on December 1. Whispers in the garages pointed to JR Motorsports (JRM), co-owned by NASCAR icon Dale Earnhardt Jr. and his sister Kelley Earnhardt Miller, as the frontrunner to scoop up the charters. JRM, a powerhouse in the Xfinity Series with multiple championships, had long eyed a Cup Series leap.

Recent court filings from NASCAR fueled the buzz, noting an unnamed party had “expressed interest in obtaining a Cup Series Charter to NASCAR executives multiple times over the past several years.” Fans and insiders on X latched onto JRM as the likely buyer, with posts speculating, “JRM! Dale Jr. is coming to Cup!”

Denny Hamlin paced the 23XI shop in Mooresville, North Carolina. “We’ve poured millions into this—Jordan’s vision was to build something lasting,” he confided to his crew chief. Michael Jordan, watching from Chicago, was livid. “I don’t back down from bullies,” he growled during a tense video call. But without charter payouts—estimated at $10 million per car annually—the teams bled cash. Sponsors wavered, drivers like Reddick eyed escape clauses, and whispers of shutdowns echoed through the pits.

Bob Jenkins tried to rally FRM in Statesville. “We’ve won the Daytona 500 with McDowell; we can fight this,” he told his staff. But reality hit hard. FRM’s third charter, bought from the defunct Stewart-Haas Racing for $20-25 million, now hung in limbo. Charters had ballooned to $40-45 million each, and without them, operations could fold by season’s end.

The auction kicked off quietly in late September, shrouded in secrecy to avoid trial interference. NASCAR’s filings revealed a 30-day bidding window, with proceeds potentially funneled back to 23XI and FRM if they won—but only as monetary damages, not the charters. Bidders emerged from the shadows, but JRM’s name dominated speculation. NASCAR’s filing described the redacted buyer as a team with “long-standing interest” and deep ties to the sport’s legacy, a clear nod to JRM’s history and Dale Jr.’s star power.

Other contenders surfaced. Trackhouse Entertainment Group, owned by Pitbull and Justin Marks, eyed two charters to expand to four cars, leveraging their media savvy. Richard Childress Racing (RCR) bid for all six, aiming to consolidate power, though insiders whispered it was a bluff to pressure the courts. A wildcard bid came from a tech consortium led by Elon Musk’s xAI, partnering with Spire Motorsports, offering $135 million for three FRM charters with promises of AI-driven strategies. But JRM’s bid, reportedly backed by private equity interest, was the talk of the paddock.

As bids piled up, the trial heated up. Antitrust lawyer Jeffrey Kessler hammered NASCAR’s track ownership (over 70%), supplier mandates, and anti-sue clauses as monopolistic. “This is Google-level control,” he thundered. NASCAR’s defense painted 23XI and FRM as opportunists, colluding via the Race Team Alliance. Witnesses like Hendrick Motorsports’ Jeff Gordon testified reluctantly: “We signed because we had to—but it’s not perfect.”

October 1 arrived like a green flag drop. In a Charlotte courtroom, Judge Kenneth Bell delivered the verdict: The lawsuit failed. No antitrust violation; the charter system was a “fair business model.” 23XI and FRM owed NASCAR millions in repayments. The charters? Sold. JRM secured all six, a seismic move that sent shockwaves through the sport. Dale Earnhardt Jr., speaking to the press, grinned: “This is for the fans, for the legacy. JRM’s ready to race in Cup.”

By 2026, JRM fielded a three-car Cup team with Tyler Reddick jumping ship to drive the No. 8, a nod to Dale Jr.’s Hendrick days. Justin Allgaier and Riley Herbst rounded out the lineup in the Nos. 88 and 1, respectively. Trackhouse grabbed one extra charter, RCR leased one to a satellite team, and xAI’s bid fell short. 23XI and FRM limped on as open teams, with Jordan pivoting to Xfinity and Jenkins vowing a comeback.

In NASCAR’s Darwinian world, charters were survival. JRM’s bold move, fueled by Earnhardt’s legacy and new financial backing, reshaped the grid. The engines roared on, but the rebels’ dreams sputtered, a cautionary tale etched in the pits.